Whistleblower Laws, Incentives, & Protections

Whistleblower Laws Overview

Whistleblower laws in the United States provide crucial protections and incentives for individuals who report fraud, misconduct, or violations of law. The three primary federal whistleblower statutes are:

- False Claims Act (FCA): Enacted in 1863, the FCA allows private citizens to file lawsuits on behalf of the government against entities defrauding federal programs. Whistleblowers can receive 15-30% of recovered funds. The FCA covers various industries, including healthcare, defense contracting, and education. Examples of false claims that can be pursued by the FCA are:

- charging the government for more services than provided, such as up-charging Medicare/Medicaid.

- submitting false information to receive government loans or grants

- providing goods or services that are defective or that do not meet regulatory or contractual specifications

- Sarbanes-Oxley Act (SOX): Passed in 2002, SOX protects corporate whistleblowers who report securities fraud, shareholder fraud, or violations of SEC rules. It applies to publicly traded companies and their subsidiaries.

- Dodd-Frank Act: Enacted in 2010, this law established the SEC Whistleblower Program provides awards of 10-30% to eligible whistleblowers who voluntarily provide original information leading to successful SEC enforcement actions.

The Dodd-Frank Act also created a whistleblower program for the Commodity Futures Trading Commission and strengthened whistleblower protections of the Foreign Corrupt Practices Act. The Dodd-Frank Act provides an avenue for whistleblowers to report securities fraud, commodities fraud, and foreign corruption such as bribery and money laundering.

These laws offer anti-retaliation protections, including:

- Prohibition of adverse employment actions like termination, demotion, or harassment

- Reinstatement with seniority

- Double back pay with interest

- Compensation for special damages and litigation costs

Recent amendments have strengthened these protections. For example, the Anti-Money Laundering Act of 2020 expanded whistleblower protections in the financial sector.

State-level whistleblower laws complement federal statutes. Currently, 31 states have enacted their own versions of the False Claims Act, providing additional avenues for whistleblowers to report fraud against state governments.

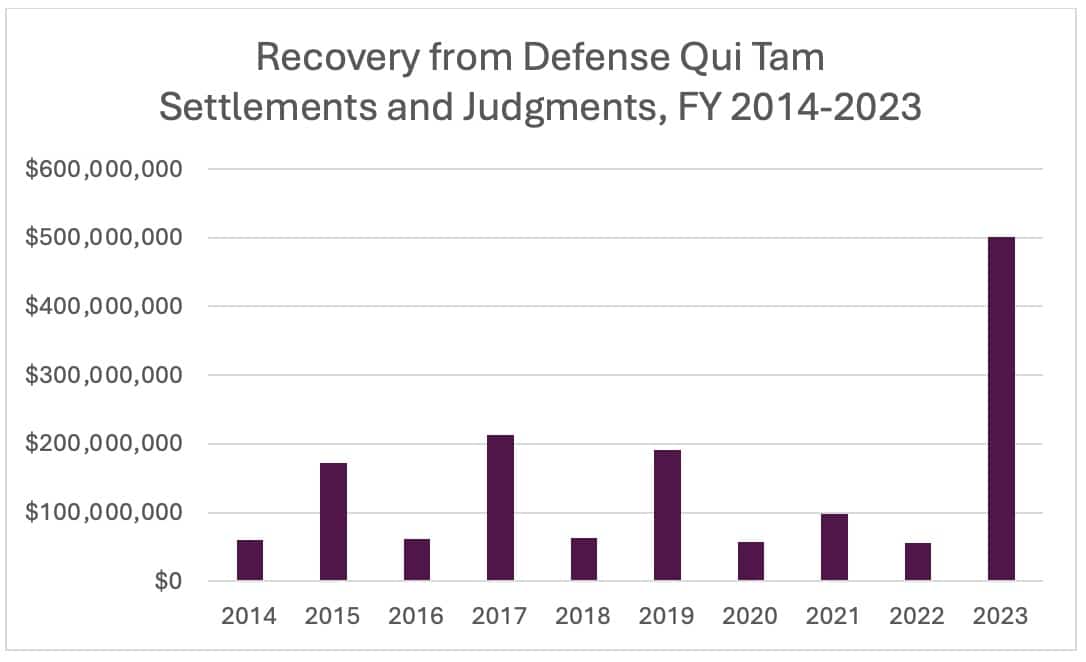

Booming Whistleblower Incentives

The effectiveness of recent whistleblower laws is evident in the record-breaking awards and recoveries in recent years. In fiscal year 2023, the SEC Whistleblower Program received a record 18,000 tips and issued $600 million in awards. This demonstrates the growing importance of whistleblowers in detecting and preventing fraud across various sectors of the economy.

In addition to helping fight corruption, this trend of significant awards demonstrates the potential for substantial compensation for whistleblowers. Notable payouts:

- In May 2023, the SEC awarded a record-breaking $279 million award to a single whistleblower, more than doubling the previous record.

- The SEC awarded $104 million to seven whistleblowers in August 2023

- The government granted a $70 million award to Sarah Feinberg in July 2023 for exposing fraud in the Booz Allen case.

These massive awards demonstrate the significant impact whistleblowers can have and the government’s commitment to incentivizing the reporting of wrongdoing.

The False Claims Act provides robust protections for whistleblowers against retaliation by employers. Key provisions include:

- Prohibiting discharge, demotion, suspension, threats, harassment, or discrimination due to protected activities

- Protecting employees, contractors, and agents who take lawful actions to stop FCA violations

- Allowing whistleblowers to seek reinstatement, double back pay with interest, and compensation for special damages

- No cap on compensatory damages, enabling potentially substantial recoveries

- A 3-year statute of limitations for filing retaliation claims

Courts have broadly interpreted protected activities to include internal reporting of potential violations. Whistleblowers are safeguarded if they have an objectively reasonable belief that their employer is violating or will soon violate the FCA.

Whistleblower Protection Takeaways

The whistleblower landscape has seen significant growth and evolution in recent years, with record-breaking awards and increased protections highlighting the critical role whistleblowers play in uncovering fraud and misconduct. The SEC Whistleblower Program has been particularly successful, with a record 18,000 tips received and $600 million in awards issued in fiscal year 2023. Notable cases include the unprecedented $279 million award to a single whistleblower in May 2023, which more than doubled the previous record.

These substantial rewards underscore the government’s commitment to incentivizing whistleblowers and the potential for significant compensation. However, whistleblowers face numerous challenges, including lengthy processing times and potential retaliation. To address these issues, bipartisan efforts like the IRS Whistleblower Improvement Act aim to strengthen protections and streamline processes. As the whistleblower landscape continues to evolve, it remains crucial for potential whistleblowers to seek experienced legal counsel to navigate the complex laws and maximize their chances of success and protection.