And what you should do about it

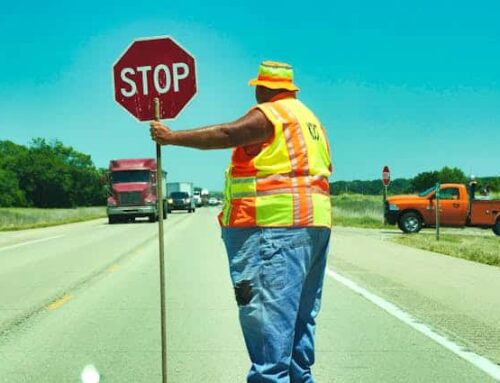

If you work in construction on government-funded projects in New York, California and much of the United States, you are likely entitled to receive prevailing wages for work on such public works projects. These are hourly rates set by the government, which tend to be similar to the prevailing union rates for workers in the community where the project is performed.

But here’s the reality: many employers report to the government that they’ve paid you the correct wage but in actuality they pay less and they pocket the difference. They’re betting you won’t notice or won’t know your rights. That’s where we come in.

At Pelton Graham, we’ve handled hundreds of unpaid wage claims on behalf of thousands of workers throughout New York and California, including some of the states’ most significant prevailing wage cases. We’ve seen employers’ tricks, and we want to arm you with the knowledge to spot them when something isn’t right. Because when employers violate prevailing wage laws, you’re the one who pays the price.

What Are Prevailing Wages?

Before we dive into the red flags, let’s make sure you understand what you’re entitled to. Prevailing wages consist of two parts:

- Base wage – Your base hourly wage rate; plus

- Supplemental Benefits – Money for benefits like health insurance, retirement benefits and vacation, which in some instances can meet or exceed the base wage.

These rates are set by federal, state and local government agencies and updated regularly. They also include overtime pay, higher differential rates for night and weekend work, and double-time for certain holidays.

Important: Your eligibility is based on the work you actually do, not your job title. Even if you’re called a “laborer,” if you’re doing skilled work such as welding or driving equipment, you should be paid the higher skilled rate.

Red Flag #1: Your Pay Stub Doesn’t Add Up

What to look for: Your pay stub should clearly show your hourly rate, hours worked, and any benefit payments or deductions. If the math doesn’t work out, or if information is missing, that’s a problem.

The reality check: Take your hourly rate and multiply it by your hours. Does it match your gross pay? Are benefit contributions clearly listed? If you can’t figure out how they calculated your pay or your contributions, government inspectors can’t either – and that’s illegal.

What you should do: Keep every pay stub. If something looks wrong, ask your supervisor or payroll department for clarification. Document their response.

Red Flag #2: You’re Being Paid “Regular” Construction Wages on a Public Project

What to look for: If you’re working on a school, government building, public road, or any project with government funding, but you’re getting paid the same rate you’d get on a private job, you’re likely being shortchanged.

The reality check: Prevailing wages are almost always higher than standard construction wages. Typically, significantly higher – about 105.2% higher in California and 115% higher in New York:

| Prevailing Wage vs Non-Prevailing Wage Construction Trades in California 2025

|

Prevailing Wage vs Non-Prevailing Wage Construction Trades in New York 2025

|

Data Sources:

-

- California Prevailing Wages: California DIR 2025-1 official determinations

- New York Prevailing Wages: New York State Department of Labor 2025-2026

- New York Comptroller Worker Prevailing Wage Schedule 2025-2026

- US Bureau of Labor Statistics adjusted for New York market

- Market Wages: BLS, Indeed, PayScale, and ZipRecruiter data

- Methodology: Conservative estimates using base rates only (excluding fringe benefits)

This data powerfully illustrates why prevailing wage laws are so important for construction workers and why violations represent such significant financial harm to working families.

If your employer says “this job doesn’t qualify for prevailing wage,” be skeptical if it is a substantial ongoing project on a governmental building.

What you should do: Ask what type of project you’re working on. If there’s government funding involved—federal, state, or local, or you are performing construction, maintenance or repair work on a governmental property, you should probably be getting prevailing wages.

Red Flag #3: Your Job Classification Doesn’t Match Your Work

What to look for: You’re doing skilled technician work but being paid as a “general laborer.” Or you’re operating heavy equipment but classified as a “helper.”

The reality check: This is one of the most common violations we see. Employers deliberately misclassify workers to pay lower rates. The difference can add up to over $100,000 per year, for example for an ironworker in New York.

What you should do: Know what work you’re actually performing. Check the prevailing wage schedules for your area (available online) to see what you should be earning for that type of work. Document the work that you are performing on a daily basis by taking pictures of your work at the jobsite. Take pictures of the construction permits and prevailing wage certified payroll timeslips when possible. Gather the names and contact information of co-workers or other witnesses who know the actual work that you performed on the projects.

Red Flag #4: No Overtime or Incorrect Overtime Calculations

What to look for: You’re working more than 8 hours a day or 40 hours a week, but not getting overtime. Or you’re getting overtime calculated on your base rate instead of the full prevailing wage rate.

The reality check: Prevailing wage overtime should be calculated as either time and one-half or double time the base prevailing wage rate plus the supplemental benefit overtime rate, as listed on the prevailing wage schedule. This can mean the difference between $75/hour overtime and $45/hour overtime.

What you should do: Track your hours carefully. Know that in many states and classifications, you’re entitled to daily overtime (over 8 hours per day), weekly overtime (over 40 hours), overtime for hours worked on Saturday and double time for work performed on Sundays.

Red Flag #5: Missing or Inadequate Benefit Payments

What to look for: Your employer increases your pay to meet the base prevailing wage rate but they pay no additional supplemental benefits. Alternatively, they claim that they are “paying benefits” but you’re not seeing health insurance, retirement contributions, or other benefits. Or they’re paying you cash “in lieu of benefits” but it’s less than the supplement amount.

The reality check: The supplement benefit portion of the overall prevailing wage is substantial – often 40% or more of the total prevailing wage compensation. If you’re not getting actual benefits, you should be getting the full cash equivalent.

What you should do: Ask for documentation of benefit payments. If you’re getting cash instead, make sure it equals the full supplement amount listed in the wage determination.

Red Flag #6: Pressure to Sign False Documents or Endorsing Checks Back to the Employer

What to look for: Your employer asks you to sign papers saying you worked fewer hours than you actually did, that you were paid more money than you actually received or that you performed a lower category of work than you actually performed. Alternatively, you are handed checks but are required to endorse them and hand them back to your employer and you are paid a much lower amount in cash or by check. Your employer may say it’s “just paperwork” or “for the government.”

The reality check: This is fraud, plain and simple. Employers do this to make their certified payroll reports look compliant while actually underpaying workers.

What you should do: Never sign false documents. This puts you at legal risk too. If you’re pressured to do this, it’s a clear sign your employer is violating prevailing wage laws. Never agree to endorse a prevailing wage check and give it back to your employer while accepting a lesser amount as your actual wage.

Red Flag #7: Threats or Retaliation for Asking Questions

What to look for: When you ask about your pay rate, hours, or benefits, your employer gets defensive, threatens your job, or tells you to “be grateful for what you get.”

The reality check: You have the legal right to know your wage rate and to receive prevailing wages if you’re entitled to them. Employers who threaten workers for asking legitimate questions usually have something to hide.

What you should do: Document any threats or retaliation. This behavior often indicates prevailing wage violations and can strengthen your case if you need to file a complaint.

How to Protect Yourself: Documentation Tips

We’ve written a guide on How to Prepare for Meeting with an Attorney about Unpaid Wages. Key takeaways:

Keep detailed records:

- All pay stubs and timecards

- Photos of job sites and any posted notices

- Names of contractors, subcontractors and co-workers

- Names of governmental inspectors

- Dates and hours worked

- Any conversations about wages or benefits

Know your rights:

- You can discuss wages with coworkers (this is legally protected)

- You can request certified payroll records for your project

- You can file complaints without fear of retaliation

Get the facts:

- Check prevailing wage schedules online for your area

- Verify whether your project receives government funding

- Calculate what you should be earning versus what you are actually paid

What You Can Recover

If you’ve been underpaid prevailing wages, you may be entitled to:

- Back pay for the difference between what you were paid and what you should have been paid

- Interest on unpaid wages

- Penalties for willful violations

- Attorney’s fees and legal costs in certain instances

The bottom line: Employers who violate prevailing wage laws face serious consequences, including being banned from future government contracts. That’s why many are willing to settle quickly when confronted with evidence of violations.

We’re Here to Help

At Pelton Graham, we are experienced prevailing wage lawyers in New York and California, and we’ve recovered tens of millions of dollars for construction workers who were denied their rightful prevailing wages. We work on a contingency fee basis, which means we only get paid if you get paid.

If you’ve spotted any of these red flags in your own situation, don’t wait. Prevailing wage violations often affect multiple workers on the same project, and the sooner you act, the stronger your case will be.

Contact us today for a free consultation.

Remember: You deserve to be paid fairly for your work. We’re here to help make sure that happens.

Leave A Comment